Barbicide and Playboys

For the past few weeks, memory fragments have been floating around in my head like combs in that blue liquid barbers used when I was a kid and my dad steered me to the Sports Illustrateds instead of laminated copies of Playboy while I waited for Vinnie to give me my short back and sides cut.

Stewardesses on American Airlines who passed around tiny boxes of Chiclets on takeoff so my ears wouldn’t pop. Knowing I had to floor a K-Car for 12 seconds to get on a highway. Experiencing the dot-com explosion as a grown-up.

It took me ages to realize they weren’t random. They’re the Halloween candy not one kid came to trick or treat for (Literally zero. What’s that about?) that leads to a witch’s house made of preapocalyptic techonomic implosion… and gingerbread.

Forgive me for misquoting and rearranging John Hughes’ Turkey Day masterpiece but…

WHEN IT COMES TO

PLANES, AUTOMOBILES,

AND TECH-LIKE THINGS

THERE’S A PATTERN.

BUSTS.

BAILOUTS.

AND THE SUSPENSION OF DISBELIEFS.

PLANES

As a business, airlines suck. In 1997, Warren Buffett aw shucks-ed it like this, “The worst sort of business is one that grows rapidly, requires significant capital to engender the growth, and then earns little or no money. Think airlines.” At the best of times, airlines live on razor thin margins. In times of crisis, they collapse. After 9/11, We the People gave them $15B to keep flying empty planes We were too scared to fly. That’s a bailout. COVID caused copious calamity. So We handed the magnificent CEO who run flying machines another $54B. And, for Our two bailouts totaling nearly $70B, we got nada. We didn’t get air miles. We didn’t get little bottles of booze. Hell, we didn’t even get Chiclets two-packs.

AUTOMOBILES

We bailed out car companies twice too.

In the late 70s, Chrysler built big cars no one wanted before any asked for them. With loads of cars rusting in lots all over the place, Chrysler was in big trouble. So, We gave them $1.5B in 1979. Well, We didn’t give them the money. We asked banks to lend them the money and promised We’d pay it back if they couldn’t. We had to. Chrysler was so big that if they went bust, lots of people would lose jobs and the impact on the economy would be huge. Jimmy Carter said it this way, “It protects the interests of the American taxpayer. It also protects the soundness of the American free enterprise system.” If you have a sec, send me a note explaining how a government bailout protects free enterprise.

Our money led to the K-Car. Which was, to be fair, a marvel of industrial efficiency. Instead of lots of different cars built on lots of pieces, nearly every car in Lee Iacocca’s Chrysler was a version of a K-Car. From coupes to sedans to Magic Wagons.

All of this worked really well. We didn’t need to save the auto industry again for nearly thirty years. But… but… this time car companies were only partly to blame for their ruin. In 2008, banks blew up so We couldn’t borrow money to buy cars and protect the American free enterprise system. Since We couldn’t afford to borrow money to buy cars, We gave car companies $81B to not get cars. You know, sometimes, when you write things simply and peel away layers of jargon, the things We do sound really stupid.

This time Chrysler got money. GM got money. The part of GM that messed up car loans got money. Ford didn’t get money. But the part of Ford that acted like a bank did.

We’re told (by AI) that this intervention saved the U.S. auto industry. In part by gifting America’s Chrysler to Italy’s Fiat. George H. W. Bush put it like this, “If we were to allow the free market to take its course now, it would almost certainly lead to disorderly bankruptcy.” And, really, who wants a disorderly bankruptcy?

TECH-LIKE THINGS

Which brings us to tech-like things. Notice, I didn’t say tech things.

Housing Analyst, Amy Nixon posted the other day on X that Airbnb is a tech stock. I’d tell you her credentials but I can’t find them. Like Kim Kardashian who seems to be a celebrity because she tells us she’s a celebrity, Amy seems to be analyst because she tells us she’s an analyst. On her podcast, on Twitter, on YouTube, and when she pops up on Fox News. When people pushed back on her Airbnb is tech claim, she said she’s right because AI says she’s right. That faint sound you hear off in the distance is Kim Kardashian slow clapping.

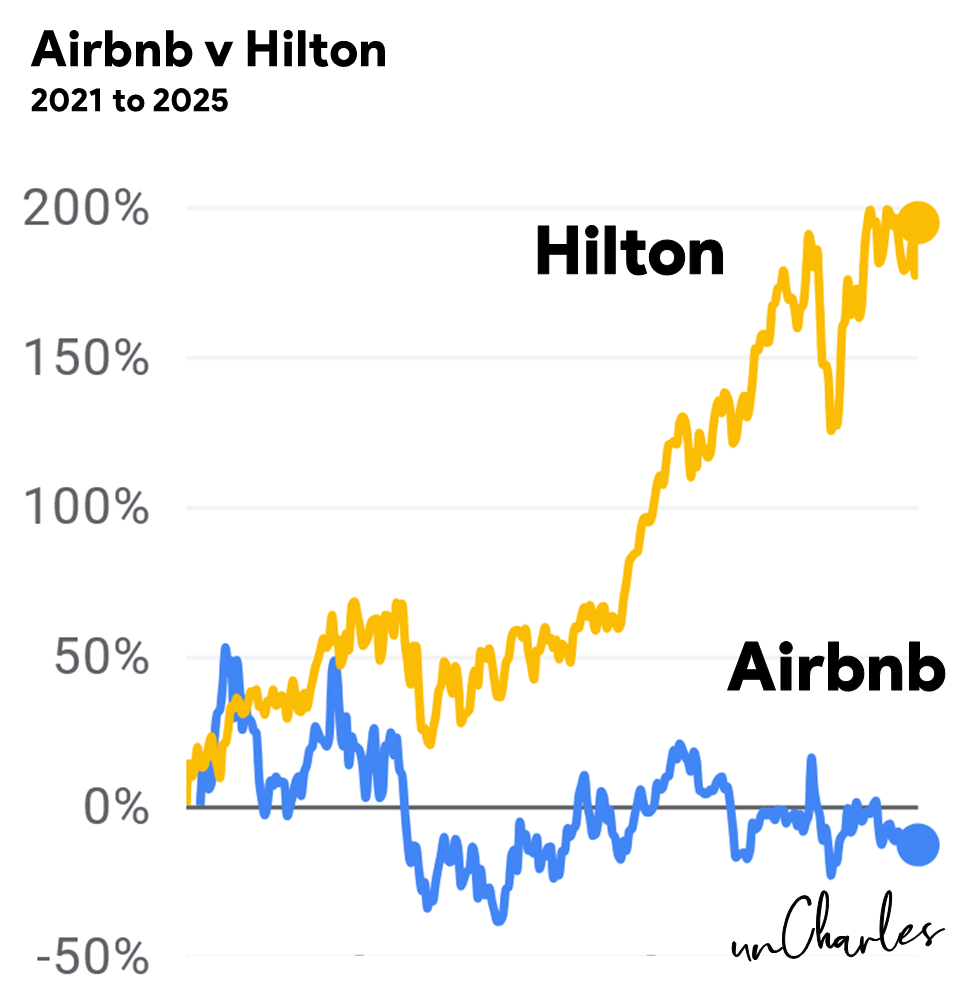

Sorry, but Airbnb isn’t a tech company. It’s a faux hotel company. A faux-tel company. It’s no different than Hilton. Actually, it’s worse than Hilton. In the last five years, Hilton stock is up 200%. Airbnb is down 13%. Hilton even gets a higher multiple of profit.

Does it matter what a tech company is and what a non-tech company is? Yeah. tech companies don’t need bailouts. Google, Microsoft, Meta, don’t ask the stewards of We the People for money. They ask not to be broken up. Do me a favor and ignore the time Apple was nearly bust and Microsoft gave them a payday loan.

The biggest deal of the dot-com era was AOL merging with Time Warner. We thought AOL was a tech stock. It wasn’t. History records the AOL-Time Warner deal as a merger. It wasn’t.

Here’s some fresh-ish thinking. AOL wasn’t a tech company. It was a media company. Not a even tech-media company. Just a media-media company. It produced content. Around which a team of 400 people sold non-personalized ads. That’s different from Google and Meta who used tech to curate my content and show me ads. But that media part wasn’t AOL’s real business. AOL made their real money charging people to pay to get on the Internet. In 1999, the last year before the *cough* merger *cough*, AOL sold $352M (25%) of ads and got $1.1B (75%) from people going online.

Still three hundred and fifty two mill of online ads made AOL the bell weather of the Internet ball. Every other dot-com who didn’t get a billion dollars for dialup had to show they could scale ads just as fast as AOL. That led to some very create accounting dressed up as very creative business development.

A dot-com company would trade ads on their site for ads on your site. These barter deals were great. Every dot-com showed lots of ad revenue. Better, they showed they were selling ads at ever-higher prices. I have no issue agreeing to pay ten cents for ads you can’t sell for two cents. Me.com has no issues agreeing to pay You.com ten cents for ads you can’t sell for two cents. Because you’re paying me ten cents for my unsold two-cent ads. Really, no one is paying anyone. We’re just trading worthless stuff into actual numbers that end up on income statements.

Then, we issue a press release that have headlines with some commas and lots of zeros.

Me.com and You.com Enter Into a $50,000,000 Partnership.

These announcements sound even better when you add equity.

The deal also includes a swap of stuff that the uninitiated might call EQUITY.

This is win-win leveraged with magic winning fairy dust. Investors love headlines like these. So, they buy stock. The stock prices go up. The value of the equity Me and You traded goes up. All of which shows up on the balance sheet. Which validates the faith that investors put in our company. So, I do more deals. Bigger deals. At higher prices. And people buy more shares.

Everything in this bull-drawn pumpkin carriage is fine. As long as no one goes bust. Because, then, the clock strikes midnight and Bibbidi-Bobbidi-Boo the entire scam is exposed.

On some level the the magnificent men who ran AOL must have known that their dialup business was going to start to rust like Chrysler’s pre-K Dodge Aspens and Plymouth Volares. AOL needed a bailout.

But you can’t tell the government you need a bailout while you’re tell people you’re a tech darling with growing revenue. So, AOL got smart. They sold Time Warner a reverse bailout story. And, they got real money to protect their faux-tech business. The companies split nine years later and AOL has been sold and re-sold for scrap multiple times since. Most recently last year — for about 1% of its *cough* merger value *cough*.

Like Chrysler’s K-Car, AOL showed us people would go online and that ads could flourish there. There was revenue but there was no long-term business. AOL was a legecy business pretending to be the future.

BARBICIDE

Still, I couldn’t quite understand why these stories were spinning around in my blue matter. Until I started to see the tell-tale signs of a pending tech economic meltdown. Techonomic.

It started a few weeks ago.

This year, OpenAI has entered into one trillion dollars of deals with big companies. Real companies. Companies that — back in 1999 — we would have thought of as Time Warner. Here are a few.

OpenAI inks $22B deal with CoreWeave for compute capacity.

OpenAI signs a $38B pact to run AI in Amazon’s AWS Cloud.

OpenAI agrees to buy up to $380B in chips from AMD.

OpenAI will spend up $300B to get compute capacity from Oracle.

OpenAI will use up to $500B to deploy Nvidia AI infrastructure.

(oh, and Nvidia will invest $6.6B in OpenAI)

While you can’t buy OpenAI stock, you can buy stock from every one of these companies. CoreWeave is up 160% this year. Amazon is up 11%. AMD up 93%. Oracle up 44%. Nvidia, 36%.

Updating the adage: no one ever got poor underestimating the intelligence of issuing a press release with OpenAI to American public investors.

To make this work, OpenAI will get big. How big? Fortunately, Tomasz Tunguz did the math. I found his bona fides. Undergrad and graduate degrees in Engineering from Dartmouth. Product Manager for Ad Sense — Google’s recurring revenue perpetual motion hamster wheel. And, since 2008, a bigwig in venture capital. Tunguz’s math says OpenAI will need to reach $577B by 2029 with 70% margins to utilize and PAY FOR all those chips and compute infrastructure.

In four years, can OpenAI do 63% more revenue than Google did last year? Cha. We’re talking about AI here. The single biggest thing to change our lives since planes, trains, automobiles, and the Internet — combined. It’s growing faster than even AI can count.

But what if it doesn’t? Is there a chance a business running on negative margins could collapse if something doesn’t go perfectly? All of a sudden these numbers start to look pretty big. $300B for Oracle is more than twice as much as the $130B it cost Us in 2008 to keep the entirety of auto AND airline industries going.

Bibbidi-Bobbidi-Bugger. Payback could be a bitch. OpenAI has raised $58B. No one seems to know how much it has on hand after funding all those losses. Per the FT, one Silicon Valley investment veteran said: “The company is in a far more capital-intensive business than Google or Microsoft ever was.” So it can’t possibly make good on all the deals it signed.

Wait. Dail that back. What did Buffet say? You don’t want to be in industries that grow fast and need big money. Huh.

Do you think Sam Altman who runs OpenAI thinks this?

But what if things did slow? Or worse? OpenAI can’t go to the government for a bailout when you tell people you’re a tech darling with growing revenue. They need to get smart about this.

There’s a concept in bailouts known as Too Big to Fail. But those are just words.

Too big to fail really means, “You create lots of jobs We can’t afford to lose.” In 1979, Chrysler employed 122,000 people. When you add the companies that supplied parts for Chrysler cars and people who worked at dealerships, that number was huge. We couldn’t risk losing that many jobs. OpenAI employs about 7,000 people. We’re not going bailout OpenAI to save those jobs.

Sometimes Too big to fail can mean, “Too Connected to Fail.” When you look at the financial crisis of 2008, AIG got $85B because they were connected to so many other financial institutions. A world wide web of counterparties whose risk isn’t just large, it’s correlated. If We let AIG fail, the entire financial system would be so weakened that it could implode.

Look at the deals OpenAI is making. They’re making themselves the AIG of the AI world. Chips makers and infrastructure players have counterparty risk with OpenAI up the wazoo. If OpenAI can’t make good on those deals, the stocks of AMD, CoreWeave, Nvidia, and Oracle could get hit hard. It won’t be pretty. That may not be enough to get Us to bail out OpenAI, but it may get Us part of the way there.

Which brings us to the past few days.

OpenAI CFO Sarah Friar said she’d like the US government to “backstop” the company’s data center commitment. People didn’t like that. Reflected in a 7% drop in Nvidia shares. Huh.

So, Sam Altman walked it back. Sam said he just wants government to play “their part” in building real industrial capacity. If you have a sec, send me a note explaining how that’s not a bailout. Sam added that OpenAI would play its part. Until, that is, until Brad Gerstner asked Sam how he’d fund OpenAI’s $1.3T in commitments. Then Sam got um, testy, “We can sell shares to the public.” Don’t like that? Yesterday, Sam suggested We expand the CHIPS Tax Credit to include AI data centers. Huh.

If it were only Sam and Sarah talking about this, you’d think this is an OpenAI issue. But, then, Jensen Huang the CEO of Nvidia told the FT, “China would win the AI race versus the US.” Huh.

Taken individually, these are just comments. But that pale blue liquid has a way of clarifying things. The AI world is in more trouble than you’d think. There’s a product and demand, but

THE PLAYBOY CEOs WHO RUN THE AI WORLD HAVE TURNED THEIR INDUSTRY INTO A HIGHLY LEVERAGED FLYING MACHINE RIPE FOR COLLAPSE.

So, now, to fend off troubles, they’re pre-asking Us for a bailout by tugging on Our heartstrings — American exceptionalism, free enterprise, disorder, and counterparty correlations that could bring down a world wide web of legacy companies pretending they’re the future.

If the clock strikes midnight on OpenAI’s pumpkin carriage — who pays?

Altman is setting it up so We are on the hook.

This is how We are really going to pay for AI.